Wir haben leider kein passendes Ergebnis gefunden.

Autonomous remote user tests

Online User Testing without Interviewer

Remote UX Testing has been an established method in many companies for several years now to get online feedback from users in an efficient way. What is new for many of our customers, however, is remote testing without moderation by an interviewer ("autonomous remote user tests"). Due to tight budgets and timings, this method is becoming increasingly popular. In addition, larger and geographically widely distributed target groups can be reached.

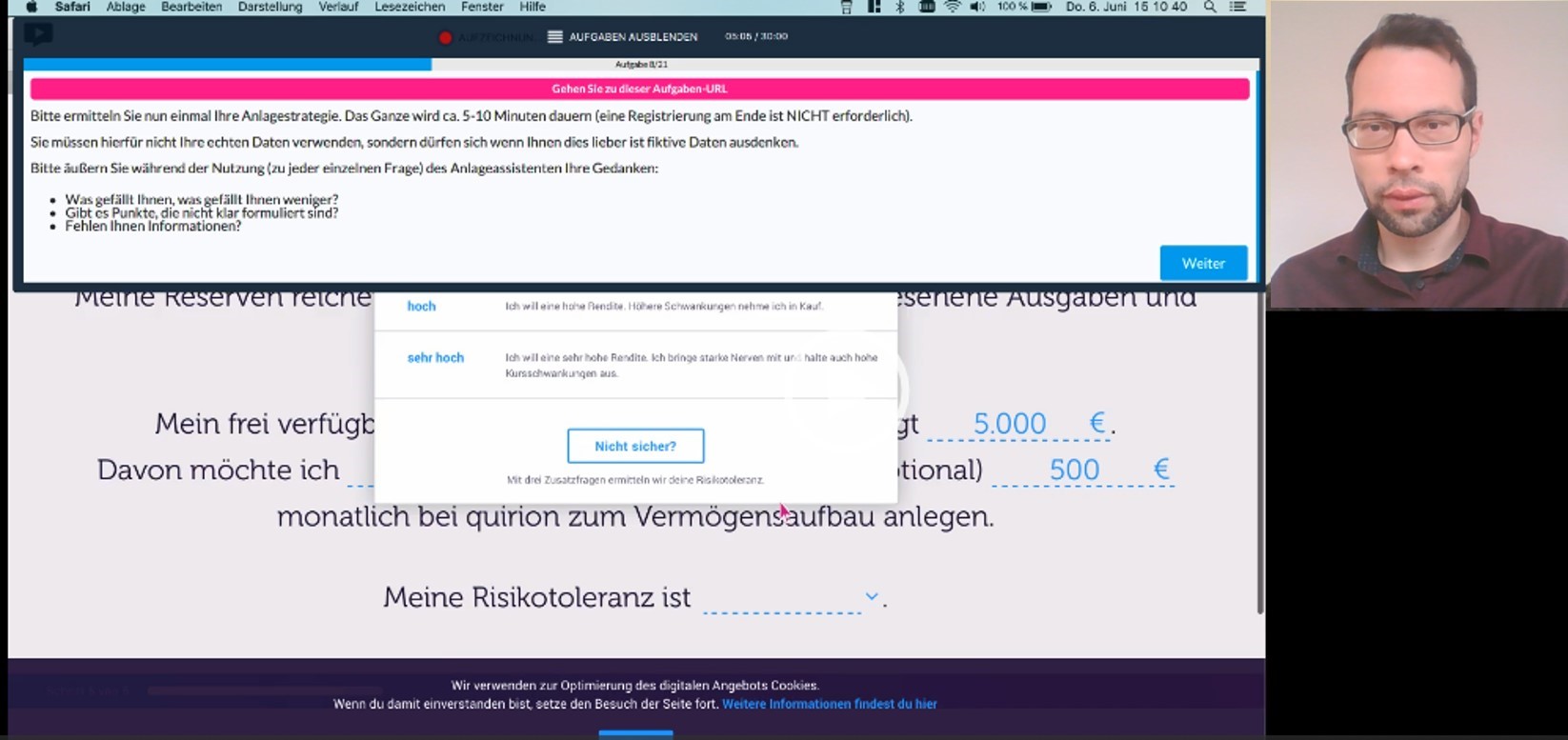

Test persons complete tasks with the help of an online-implemented guideline. Thoughts and evaluations can be spoken out loud, just like user tests in the UX studio. A video recording via webcam and screen also allows users to be observed.

FACIT DIGITAL STUDY: ROBO ADVISORS FROM THE USER'S PERSPECTIVE

We analyzed three robo advisors with the help of these autonomous remote user tests. Only a few years ago, suppliers in this segment were unknown. In the meantime not only small start-ups serve this market, but also some large suppliers want to work this supposedly lucrative market segment. Thus, in addition to VisualVest as a provider under the umbrella of the Volks- und Raiffeisenbanken, Deka also started with its own offer. But how do the providers succeed in convincing potential users of their offers? Do the providers manage to persuade the users to place an investment?

To answer these questions, we have conducted user tests. 12 people tested selected providers, focusing on the digital investment assistant, which recommends a more or less individual investment portfolio based on the characteristics and preferences of the respective user. The examined investment robots are offered by VisualVest, quirion and fintego.

First of all, it is noticeable that the investment robots are now seen with less skepticism than just a few years ago. Nearly all of the test users had a very concrete idea of the services these robots offer and how they work. The first hurdle, from the providers' point of view, of achieving a certain basic understanding of automated investment advice in the first place has thus been successfully overcome.

Also, usability is generally not an obstacle that prevents potential users from investing money: All three tested providers are attested an excellent overview, which is limited to its basic function. The test users did not feel overwhelmed by the assessment of their risk profile, terms are understandable in most cases or are explained if necessary, e.g. risk tolerance at quirion. It was also very much appreciated that information can easily be adjusted afterwards. However, the possibility to contact an employee in case questions arise during the determination of the risk profile was often missed. At this point it becomes clear that the human component in the financial sector cannot be completely replaced by automated processes and chat bots.

Overall, the satisfaction of the test users with the investment assistants is very positive: Ten of the 12 test users were satisfied or even very satisfied, only two were dissatisfied. However, the low level of trust represents a major hurdle to use services like these: Although the providers were perceived as serious and professional, questions remained unanswered as to who exactly is behind the providers. A well-known, established brand name is still extremely important in connection with financial services. VisualVest in particular leaves a lot of potential here, whose affiliation to Union Investment is not recognizable from the user's point of view. VisualVest is described as a small start-up that has a successful digital platform but is not considered as a provider for an investment. A strong reference to the affiliation to one of the largest financial associations in Germany would be very helpful to create trust.

CONCLUSION

In addition to establishing a strong, trust-building brand, a successful customer approach also requires the right mix of digital services and support from real people at the critical points in the customer journey. Regular tests with users - whether in the studio or online & without a moderator - are therefore indispensable in order to align the offers with the interests of the users.

Andre Soldwedel

Andre is Senior Consultant at Facit Digital and at home in qualitative and quantitative research. The direct exchange with users of digital products and services is particularly important to him in order to be able to design digital products and services in the way the end customer needs them.